Delivering confidence, compliance and control over short-term liquidity with automated real-time visibility, monitoring and management

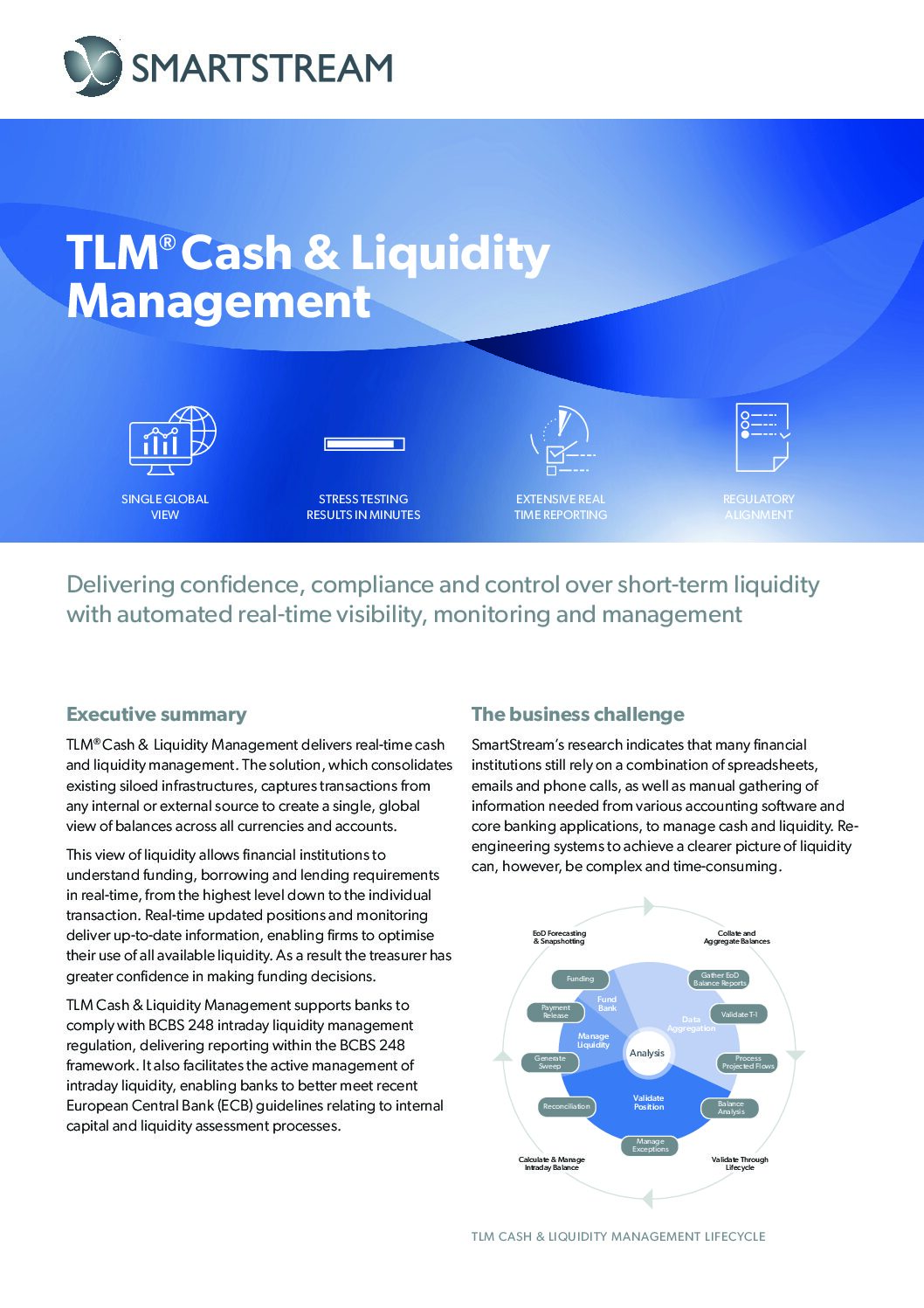

TLM® Cash & Liquidity Management delivers real-time cash and liquidity management. The solution, which consolidates existing siloed infrastructures, captures transactions from any internal or external source to create a single, global view of balances across all currencies and accounts.

This view of liquidity allows financial institutions to understand funding, borrowing and lending requirements in real-time, from the highest level down to the individual transaction. Real-time updated positions and monitoring deliver up-to-date information, enabling firms to optimise their use of all available liquidity. As a result the treasurer has greater confidence in making funding decisions.

TLM Cash & Liquidity Management supports banks to comply with BCBS 248 intraday liquidity management regulation, delivering reporting within the BCBS 248 framework. It also facilitates the active management of intraday liquidity, enabling banks to better meet recent European Central Bank (ECB) guidelines relating to internal capital and liquidity assessment processes.